Understanding Term Life Insurance

Mar 20, 2024 By Triston Martin

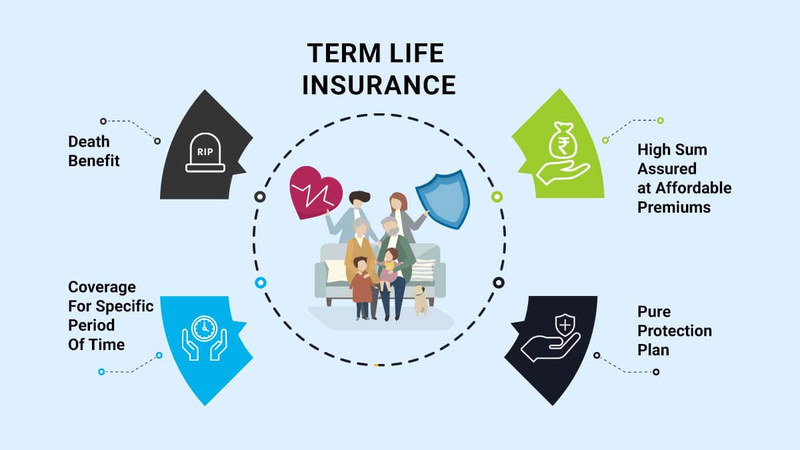

Term life insurance, a straightforward type of coverage, safeguards you for a specified period, usually between 10 to 30 years. In contrast with whole life insurance that provides lifelong protection and incorporates savings components, term policies aim at furnishing financial security over limited durations. This article navigates you through the process. It assists in discerning an apt term life insurance policy tailored to your requirements.

Factors to Consider

In searching for a term life insurance policy, one must consider several factors to ensure an informed decision. First, assess your financial obligations. These include outstanding debts, mortgages, and future expenses such as college tuition or retirement savings. Additionally, age, health, and lifestyle habits influence the cost of premiums and determine the type of coverage available to you. Therefore, they are important considerations in this process.

Consider another crucial factor which is the duration of coverage required. Assess your family's financial needs and obligations in the upcoming years. This may extend until a period when independence for your children has been achieved, or even when you have fully paid off your mortgage. Opting for an apt term length is essential. It guarantees that during their most financially vulnerable phases, your loved ones will receive adequate protection.

- Family's Financial Needs: Take into account your family's future financial needs, such as education expenses or mortgage payments, when determining the duration of coverage.

- Health Considerations: Your health plays a significant role in determining your insurability and premium rates. Be prepared to disclose any pre-existing medical conditions during the application process.

Comparing Policies

Numerous insurance providers offer term life insurance policies. It is essential, therefore, to compare these quotes and coverage options, ensuring that you find the best fit for your specific needs. Two recommended methods of gathering multiple companies' quotes exist, utilizing online comparison tools and consulting with insurance agents. While doing this, scrutinize not only the coverage amount and premium rates but also any additional riders or benefits incorporated into the policy.

Delve into the fine print of each policy beyond its basic coverage and premiums. Search for any exclusions or limitations that might impact your coverage; also, evaluate the financial stability and reputation of insurance companies offering these policies to ensure their ability to fulfill future obligations.

- Policy Exclusions: Scrutinize each policy for any exclusions or limitations that may affect your coverage, such as dangerous hobbies or travel restrictions.

- Financial Stability: Research the financial stability and reputation of insurance companies to ensure they can meet their obligations in the future.

Online Tools and Resources

The internet offers a plethora of resources to assist you in your search for term life insurance. Many insurance companies provide online calculators that can help you estimate your coverage needs based on factors such as income, expenses, and existing assets. Additionally, there are independent websites and forums where you can read reviews and testimonials from policyholders to gauge the reputation and reliability of different insurance providers.

Consider seeking advice from financial advisors or insurance professionals in addition to utilizing online tools. Their expertise can offer personalized recommendations grounded in your unique financial situation and long-term goals. They are instrumental in helping you navigate the complexities of term life insurance, thereby ensuring an informed decision is made.

- Professional Guidance: Don't hesitate to seek advice from financial advisors or insurance professionals to gain personalized recommendations tailored to your specific needs.

- Independent Reviews: Explore independent websites and forums to read reviews and testimonials from policyholders, gaining insights into the customer experience with different insurance providers.

Consulting with an Agent

Online research possesses value. However, the personalized guidance tailored to your specific circumstances, that you can receive from an experienced insurance agent, is unparalleled. They will explicate complex insurance terminology, answer any queries you may have, and guide you smoothly through the application process. Moreover, their expertise extends toward comparing policies across various insurers to secure optimal coverage at a competitively attractive rate.

An insurance agent can further your understanding of the diverse riders and optional features accompanying term life insurance policies. These options may encompass accelerated death benefits, which permit you to tap into a portion of your policy's death benefit upon receiving a terminal illness diagnosis. An exploration into these supplementary advantages could bolster not only your coverage but also offer increased peace for both yourself and those dear to you.

- Optional Features: Work with your insurance agent to explore optional features and riders available with term life insurance policies, such as accelerated death benefits or waiver of premium riders.

- Underwriting Process: Understand the underwriting process involved in obtaining term life insurance, including the medical examination requirements and how your health history may impact your premiums.

Reviewing Policy Terms

Carefully review the policy's terms and conditions before finalizing your decision, ensuring that you understand the provided coverage as well as any limitations or exclusions. Factors such as premium payment schedule, renewal options, length of coverage term, and even conditions for payout in case of a claim, demand your attention. If uncertainties arise, seek clarification directly from your insurance agent or the company without hesitation.

Understanding the implications of policy lapses or cancellations stands as a crucial task. Consider reviewing termination conditions, penalties, and fees associated with premature terminations. Also, ponder over the policy's flexibility. Specifically, options for converting term life insurance into permanent coverage in response to future changes in your needs.

- Policy Flexibility: Assess the flexibility of the policy, including options for converting term life insurance into permanent coverage or adjusting coverage amounts as your needs evolve.

- Termination Conditions: Review the conditions under which the policy may be terminated, including any penalties or fees associated with early termination.

Conclusion

You need not find the task of locating an appropriate term life insurance policy daunting. Understand your needs, compare policies, use online tools, consult with agents, and scrutinize policy terms to confidently navigate this process. Secure necessary financial protection for yourself and your loved ones. Invest time in meticulous research and thoughtful consideration to ensure future peace of mind through an informed decision-making approach.

FinTech

Revolut Business and Amex Partner for Payments

Discover how Revolut Business and Amex's partnership enhances payment acceptance for merchants worldwide.

Learn More

Banking

Navigating Financial Success: A Comprehensive Guide to Wells Fargo Credit Cards

Explore Wells Fargo credit cards for financial success. Learn about rewards, APR to make informed decisions.

Learn More

Mortgages

How Long Does It Take to Get a Home Equity Loan?

Find out how long it typically takes to get approved for a home equity loan, what the process involves, and tips to expedite your loan approval.

Learn More

Investment

Liability Insurance Explained: How Much Do You Really Need?

Discover the importance of liability insurance for drivers and how to determine the right coverage amount to protect yourself.

Learn More

Banking

All About WebBank

Steel Partners Holdings L.P. is the primary parent company of WebBank and is headquartered in New York. Steel Partners is a diversified financial services and industrial products firm with interests in energy, defence, direct marketing, logistics, and more.

Learn More

Investment

An Eccentric Guide: How Snapchat Makes Money

Snapchat is an app that allows users to send other private messages and share photos and videos with their friends and family. On this platform, users can send and receive messages, photographs, and videos that vanish after being viewed by the recipient.

Learn More