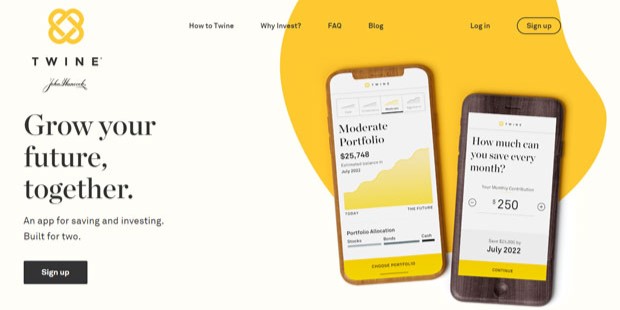

Twine App Review: A Good Investing and Saving Tool

Mar 14, 2024 By Susan Kelly

Ever wondered what's the common source of argument among couples? It's money. Yes, we can't deny discussing it if you plan to get married. Suppose you and your partner have different financial views and have not discussed them before. What will happen? It will become severe with time and can strain your relationship.

Turn your chin up because we have a definite solution to this concern. The only way to eliminate this tension is to create a financial roadmap to ensure a healthy future for your married life. Saving money is not a breeze, but first, you and your partner should agree on how to save and invest. That's where the Twine app comes in. This article will provide you with a detailed Twine App Review. So, stay tuned till the end!

Twine App Review: An Ultimate Source of Financial Freedom

Twine App Review is all about money talk. So, here you can get information on the Twine app, how to use it, its pros and cons, and how it's good for your financial status. It will save you a lot in the future.

What is the Twine App?

Twine is an investing app for couples that also provides a cash management account called Cash Account. It offers its users a higher APY than a general savings account. However, it's less competitive than other cash management account alternatives.

Twine allows friends, partners, or any two individuals to fulfill their joint investing and savings goals. It usually takes five business days to transfer money to your account, which makes it an app you can use for planning, not just acting in the time being.

How Does the Twine App Work?

Once you sign up for the Twine app, you have to connect your bank account to it so that you may set up automated savings. This can be done using their search function or by giving your account and routing numbers. Although the search function is convenient, smaller banks and credit unions may not be mentioned. If this happens, the Twine app may require a few days to verify your account.

After connecting your bank account, set your savings goal. It can be anything you choose: a dream tour, saving for your favorite car, or maybe an emergency fund. Once your goal is finalized, it's time to tell the Twine app how much you want to invest in it per month. They will debit a particular amount from your attached bank account weekly and transfer funds into the brokerage account for your goal.

There is a separate brokerage account for each goal, and you can use this amount for whatever purpose you want. You can save as cash, get a fair interest rate, or invest it further in one of the three investment portfolios (conservative, moderate, and excessive).

After accomplishing your savings goal, you can withdraw the amount from your Twine account by requesting the app. Cash savings may take 2-3 business days and 7-10 days for invested funds to reach your connected bank account.

Benefits of Using the Twine App

Many financial apps don't deal directly with couples, but that's different from the Twine app.

- Easy-to-use interface: On the Twine app, you and your partner can make your separate accounts or use one by connecting your bank account to a shared Twine account. You can create an account in no time, and its interface is easy to navigate.

- Flexibility: You don't have to open investing and savings accounts on this app. You can get one without paying fees if you want a cash savings account. But if you have to invest, you can start accumulating wealth in one of Twine's portfolios.

- Less Investment: Unlike other robo-advisors and saving apps, you can begin with Twine's app by only investing $5 in your savings and $100 in your investing account. It's an effective way for beginners to start investing with much lower capital.

- Unlimited and Custom Goals: Twine allows you to create as many joint and individual goals as possible. Although goal categories are available, you can set custom savings goals by assigning a name to them.

Drawbacks of Using the Twine App

There is no doubt that Twine is a significant saving and investing app for couples, but there are some aspects in which it loses its charm. The Twine App charges 0.60% of your total investment annually, which is expensive compared to its competitors. It's only accessible to U.S. citizens, and you can't take advantage of its Android app, which they don't have. You can only use it on the web. It also doesn't provide IRA or Roth IRA accounts. So, you can't use it for retirement savings.

Is the Twine App Safe?

Yes, the Twine app is safe to use. If the broker fails, the Securities Investor Protection Corporation (SIPC) compensates you by insuring up to $500,000 in investment and up to $250,000 in cash. Similarly, the Federal Deposit Insurance Corporation (FDIC) recovers your amount up to $250,000. This protection strategy and the fact that John Hancock handles this excellent app make it a secure and trustworthy platform to invest and save money.

Who can Use the Twine App?

If you have a specific savings goal, the Twine app can help you achieve it. You can use it as a trustworthy platform to build your and your partner's mutual savings goals. Keep in mind that the goals are reciprocal, not brokerage accounts. If you need to improve at saving independently, the Twine saving app can help you. And the best part? If you are a crazy investor and don't know how to choose ETFs or build asset allocations, Twine's app is here to give you an honest recommendation.

Conclusion

To summarize this Twine App Review, this app is a game-changer for couples trying to save and invest together. Financial planning is more accessible with its easy-to-use interface, custom goals feature, and low-investment requirements. Despite a few drawbacks, this fantastic app is a must-have tool for partners trying to build a solid financial foundation and fulfill their dreams side-by-side.

Banking

Opting Out: The Top 9 Reasons to Refrain from Using Credit

Uncover why avoiding credit could lead to financial freedom. Explore reasons to say no to credit cards and live debt-free.

Learn More

Investment

Understanding the Core of Investment Strategies: Valuation vs. Price

Explore essential investment strategies focusing on the difference between market price and intrinsic value, fundamental analysis, and how to utilize valuation for long-term success.

Learn More

Banking

2024 Guide to NASA Federal Credit Union Personal Loans: Features, Benefits, and Is It Worth It

Explore NASA Federal Credit Union Personal Loans in our 2024 review. Learn about rates, benefits, pros, and cons to see if it's the right loan for your needs

Learn More

Investment

Liability Insurance Explained: How Much Do You Really Need?

Discover the importance of liability insurance for drivers and how to determine the right coverage amount to protect yourself.

Learn More

FinTech

Revolut Business and Amex Partner for Payments

Discover how Revolut Business and Amex's partnership enhances payment acceptance for merchants worldwide.

Learn More

Investment

Twine App Review: A Good Investing and Saving Tool

This guide covers a detailed Twine App Review which is an amazing saving and investment tool for couples

Learn More